Maximizing Wealth Transfer: How High Net Worth Individuals Can Utilize Life Insurance

Savvy investors, seeking to optimize assets and ensure a smooth wealth transfer, need a bulletproof strategy for their loved ones.April 3, 2024

Enter Advanced Planning- what does that mean? This is the intersection of estate planning, asset protection and wealth creation.

Picture this: You've worked hard to amass your wealth, and you want to make sure it lands in the right hands and lasts as a family legacy. For this, you need to plan for the two biggest headwinds; Division and Erosion. Division to beneficiaries and erosion that comes from transfer taxes. Proper planning can minimize the effects of division and erosion.

Enter life insurance – often underestimated in its role but truly a powerhouse when it comes to wealth transfer. Life insurance acts as a financial safety net, providing a tax-efficient way to pass on assets to your heirs, protect your estate from hefty tax burdens, and even fund charitable legacies.

But here's the kicker – not all life insurance policies are created equal. High net worth individuals require customized solutions tailored to make sure their policies are owned and funded correctly to prevent estate tax issues. From whole life to universal life and beyond, there's a myriad of options available, each with its own set of features and benefits.

So, how do you navigate this complex landscape? Well, that's where we come in. At Catalyst Advisory, we specialize in helping individuals like you harness the power of life insurance to maximize wealth transfer. We will work closely with you to craft a customized strategy that aligns with your objectives, whether it's preserving family wealth for future generations or supporting philanthropic endeavors.

Think of life insurance as the ultimate wealth transfer tool – providing peace of mind today and a legacy that lasts a lifetime. Ready to take your estate planning to the next level? Let's chat and explore how life insurance can be the catalyst for securing your financial future.

Remember, when it comes to safeguarding your legacy, it's not just about the numbers – it's about ensuring your loved ones are taken care of for generations to come. And with the right life insurance strategy in place, you can rest easy knowing your wealth is in good hands.

Until next time, stay financially savvy and keep dreaming big

Recommended

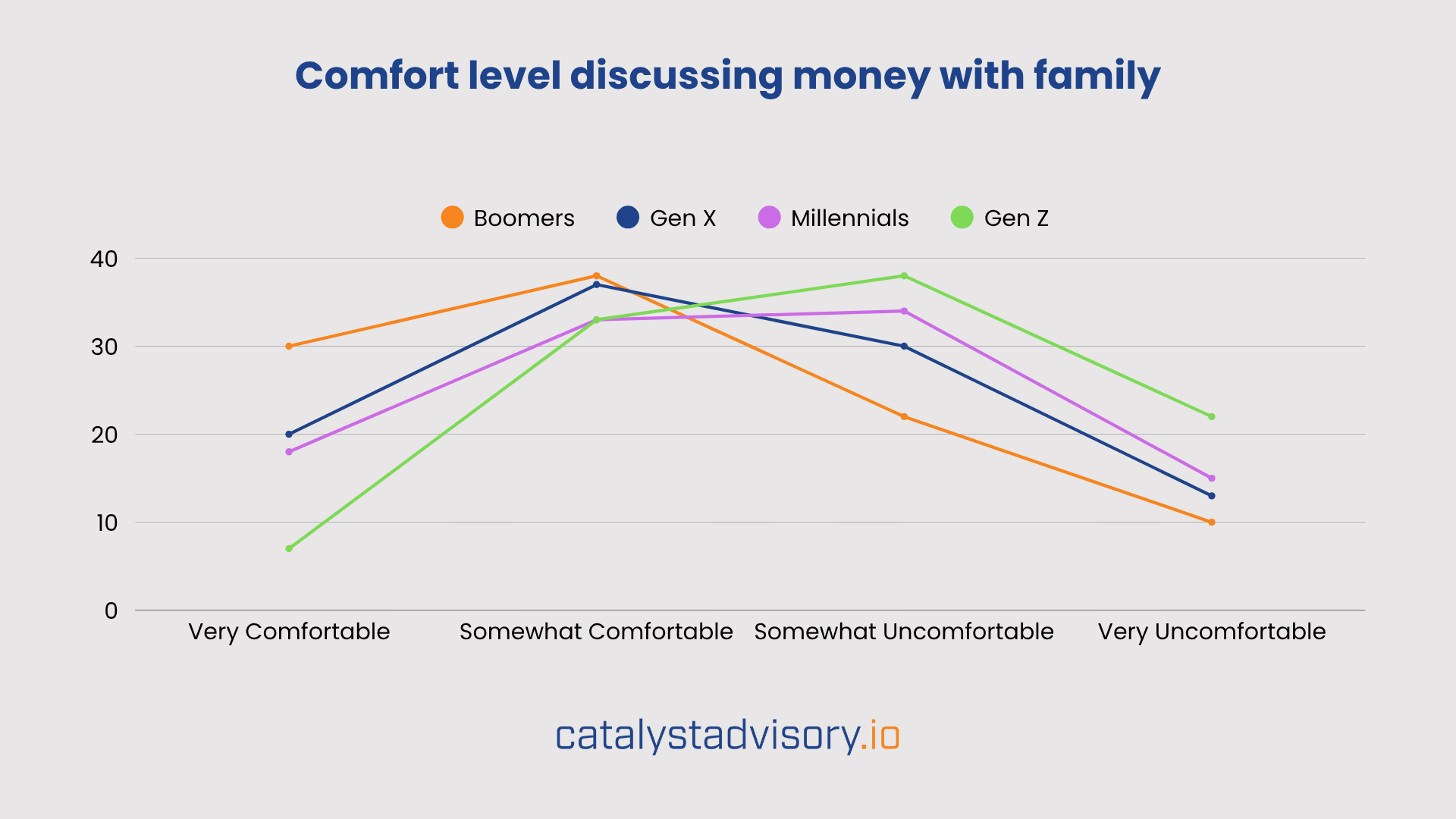

As the Great Wealth Transfer Begins, Most Families Remain Unprepared

January 6, 2026

The largest intergenerational wealth transfer in history is here. According to The Federal Reserve, Americans born before 1965 hold more than $105 trillion, or 63% of household wealth in the U.S. Over the next two decades, the Great Wealth Transfer will see most of that passed on to younger generations.

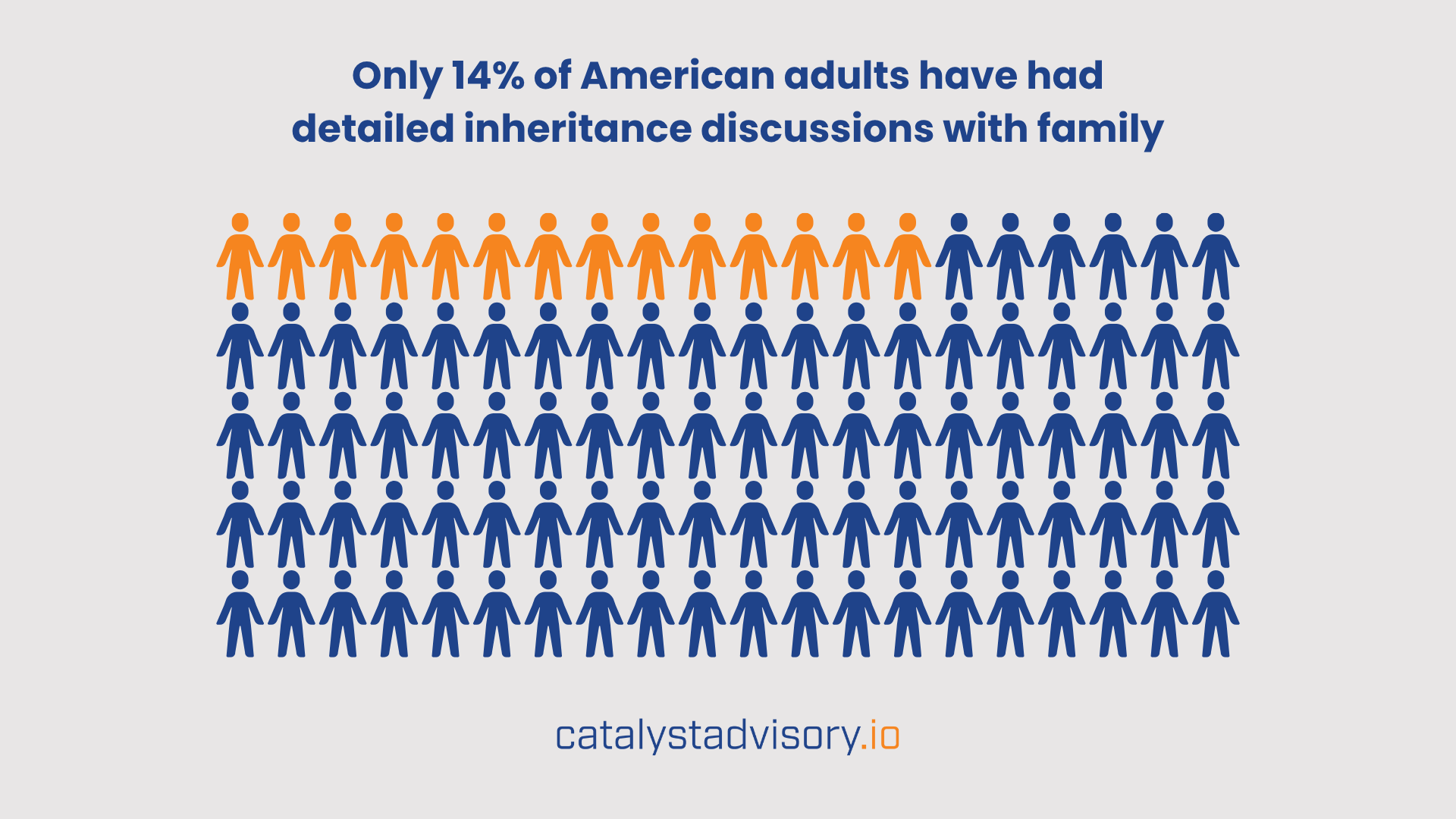

Estate Planning and the Great Wealth Transfer- National Survey Results

October 23, 2024

What our National Survey reveals about U.S. Families

Get All Our Stories in One Daily Email

It’s free. It’s daily. And it’s full of great reads, y’all.