,

Unleashing the Power of the Infinite Banking Concept for High Net Worth Investors

The Infinite Banking Concept (IBC), also known as Bank on Yourself or Bank with Whole Life, is a risk management tool, not an investment, that tackles two financial risks at once.

Steven Bowles

April 3, 2024

April 3, 2024

So, what exactly is the Infinite Banking Concept, and how does it work? At its core, IBC is a concept that utilizes specially designed whole life insurance policies as a means to create a personal banking system. Think of it as your own private financial fortress, where you serve as both the banker and the borrower.

Here's the scoop: Instead of relying on traditional banks or financial institutions for loans and financing, IBC empowers individuals to borrow against the cash value of their whole life insurance policies. But here's where it gets interesting – the borrowed funds can be used for virtually anything, from real estate investments and business ventures to education expenses and retirement planning. There is no underwriting for the loan and the terms of repayment are flexible.

Now, you might be wondering, "Why whole life insurance from a mutual insurance company?" Well, unlike other types of insurance policies, Whole Life offers a unique combination of death benefit protection and cash value accumulation along with typically strong guarantees. This cash value grows over time on a tax-deferred basis and can be accessed through policy loans or withdrawals, providing a steady source of liquidity and financial flexibility. Mutual insurance companies are owned by the policyholders and most have paid out dividends every year since the 1800’s.

But here's the real kicker – the death benefit and cash value of the policy are the collateral for the loan and your policy will continue to receive dividends while the loan is outstanding. In essence, you become your own banker, recapturing the interest and redirecting it back into your personal banking system.

Now, I know what you might be thinking – "Sounds too good to be true, right?" Well, rest assured, the Infinite Banking Concept is not a get-rich-quick scheme or a one-size-fits-all solution. Quite the opposite as it requires careful planning, disciplined financial management, and a long-term perspective.

But for high-net-worth investors seeking to maximize wealth accumulation, minimize taxes, and maintain control over their financial destiny, IBC offers a powerful alternative to traditional banking and investment strategies. By harnessing the cash value of whole life insurance policies, you can create a legacy of financial security and prosperity for future generations.

At Catalyst Advisory, we specialize in helping high-net-worth individuals unlock the full potential of their legacy. Our team of experts will work closely with you to design a customized strategy tailored to your unique goals and objectives.

So, are you ready to discover how to maximize your legacy while growing your net worth? Let's embark on this journey together and discover how the Infinite Banking Concept can be the catalyst for building a brighter financial future.

Recommended

As the Great Wealth Transfer Begins, Most Families Remain Unprepared

January 6, 2026

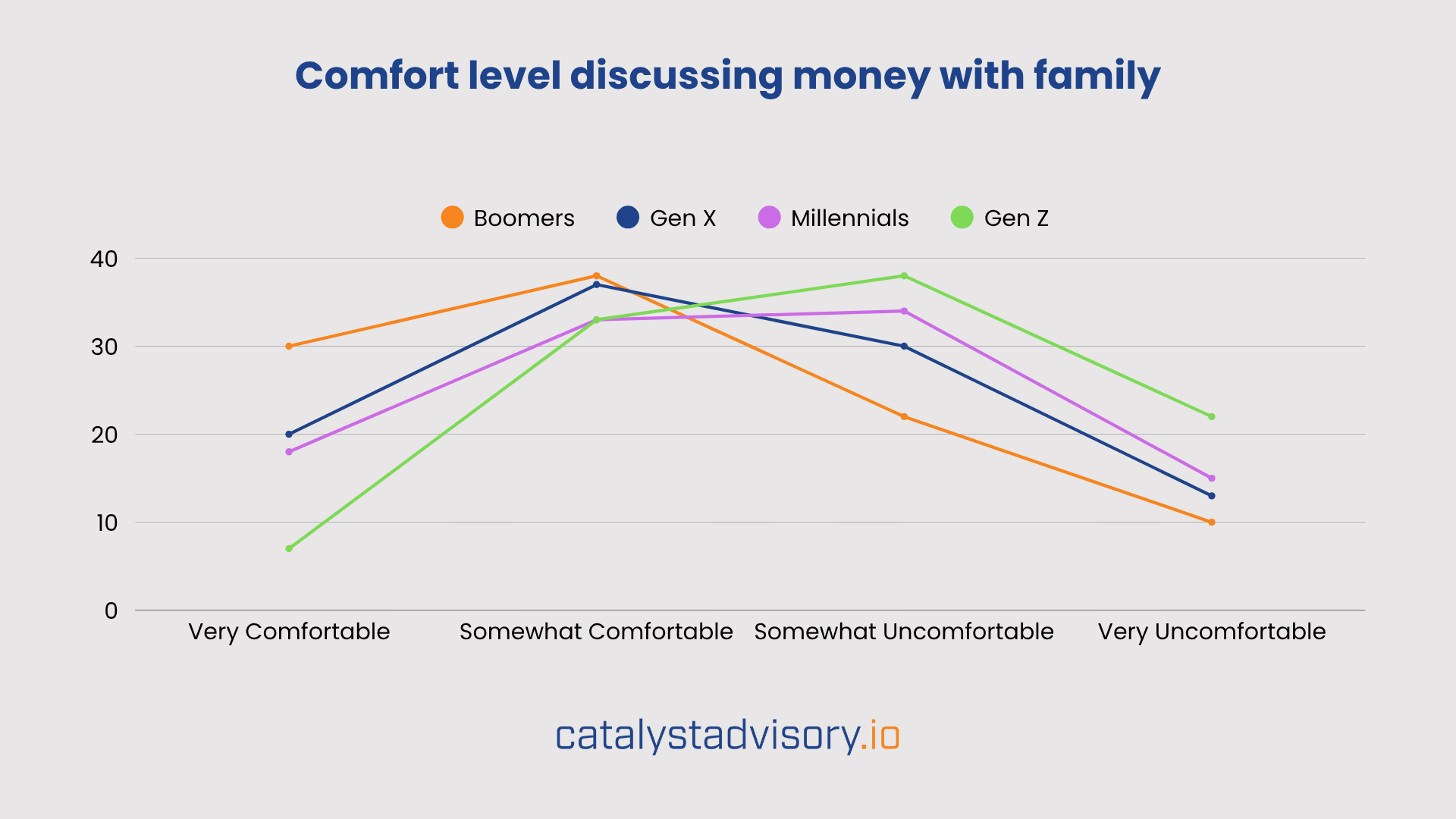

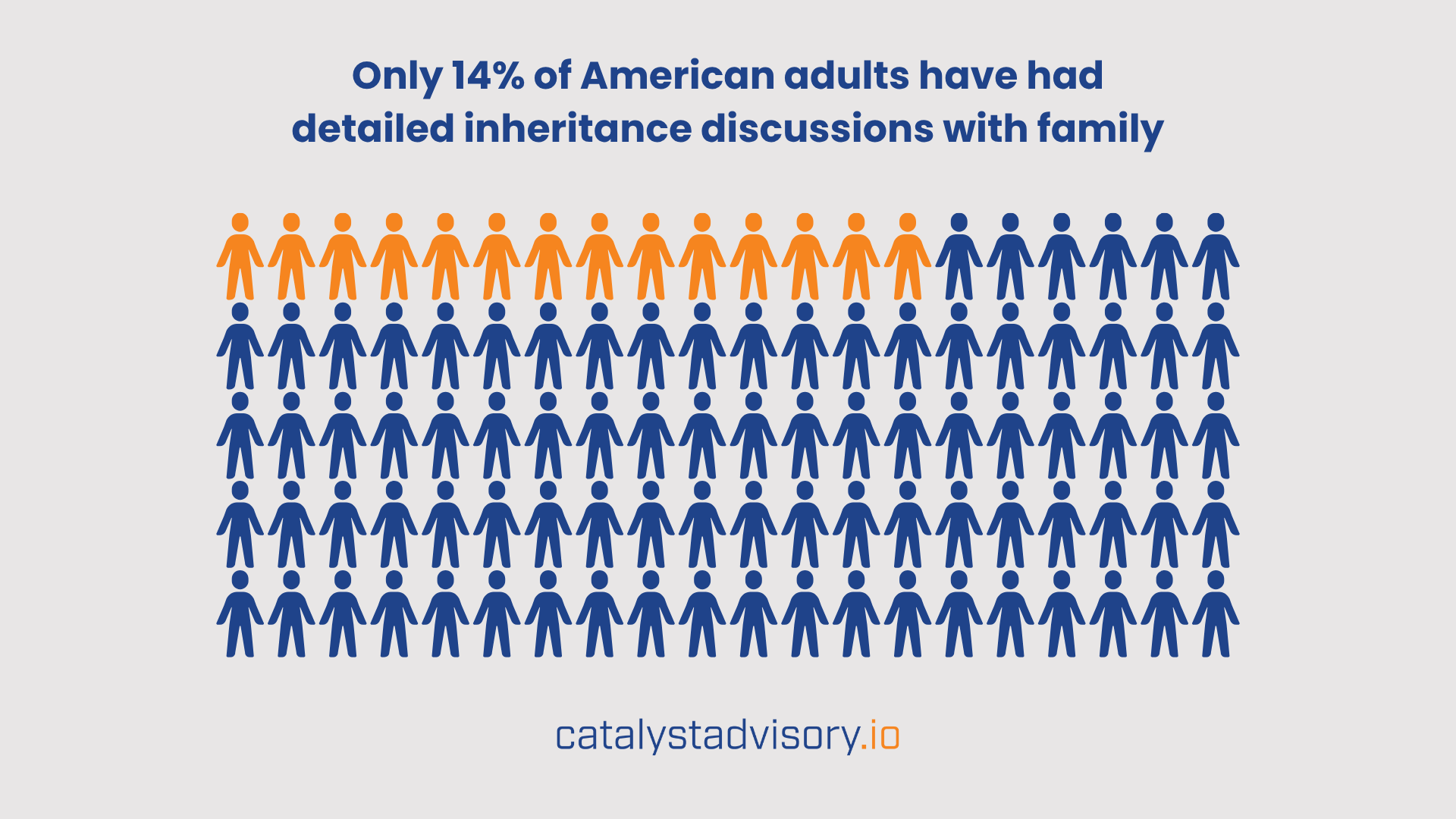

The largest intergenerational wealth transfer in history is here. According to The Federal Reserve, Americans born before 1965 hold more than $105 trillion, or 63% of household wealth in the U.S. Over the next two decades, the Great Wealth Transfer will see most of that passed on to younger generations.

Estate Planning and the Great Wealth Transfer- National Survey Results

October 23, 2024

What our National Survey reveals about U.S. Families

Get All Our Stories in One Daily Email

It’s free. It’s daily. And it’s full of great reads, y’all.