2026 Estate Tax Sunset; What Does it Mean For You?

Major changes are coming to the estate tax landscape. Estates that fall below the estate tax thresholds will suddenly find themselves subject to that tax at passing. Here's everything you need to know.April 29, 2024

Preparing for the Sunset: Navigating the Estate Tax Exemption Changes Set for 2026

In the landscape of U.S. tax law, one significant change looms on the horizon for high net worth families: the scheduled sunset of the increased estate tax exemption introduced by the 2017 Tax Cuts and Jobs Act (TCJA). This pivotal shift, expected in 2026, warrants attention and action well in advance.

Understanding the Sunset Provision

The TCJA made sweeping alterations to tax regulations, one of the most impactful being the substantial increase in the federal estate tax exemption. This change doubled the exemption amounts, allowing individuals to leave significantly more to heirs without incurring federal estate tax liabilities. As of 2024, the exemption stands impressively at about $13.61 million per individual, and effectively $27.22 million for married couples.

However, this elevated exemption is set to expire at the end of 2025, reverting to pre-2018 levels, adjusted for inflation. This means that starting January 1, 2026, the exemption thresholds could potentially halve, subject to inflation adjustments. Estates with values of roughly $7 million per individual, and effectively $14 million for married couples may suddenly be subject to estate taxes at their passing. That rate is currently 40% on all values above the exemption.

The Window of Opportunity for Estate Planning

The countdown to 2026 presents a crucial window for strategic estate planning. High net worth individuals and their families should view the next few years as a golden period for reassessing and restructuring their estate plans to optimize tax benefits. Proactive planning can significantly mitigate the tax impacts of the exemption's reduction.

Gifts and Lifetime Transfers: One effective strategy could involve making the most of the higher exemption amounts by making gifts or transfers during the lifetime. This can reduce the size of the estate that will be subject to taxes later, potentially locking in the higher exemption amount before it decreases.

Trusts and Advanced Techniques: Establishing or revising trusts can also play a pivotal role. Various types of trusts, including irrevocable life insurance trusts or charitable lead trusts, can offer flexible solutions for estate planning that minimize estate and gift taxes while supporting philanthropic goals.

Family Limited Partnerships: For those involved in family businesses, structuring family limited partnerships can be a strategic approach to manage and transfer wealth efficiently while retaining some control over the distributed assets.

Regular Reviews and Updates: Given the fluid nature of tax laws and personal circumstances, regular reviews of estate plans are crucial. This ensures that strategies remain aligned with current laws and family objectives.

Consulting with Professionals

Navigating the complexities of estate planning, especially with the impending changes, underscores the importance of consulting with estate planning attorneys and tax advisors. These professionals can provide tailored advice and sophisticated planning strategies that reflect the latest legislative updates and personal financial goals.

While the sunset of the current estate tax exemption thresholds poses challenges, it also opens a strategic planning window. For high net worth families, acting now with informed, proactive estate planning can secure financial advantages and peace of mind in navigating the evolving tax landscape. The next few years are not just a countdown but an opportunity to ensure that one's legacy is shaped as favorably as possible under the law.

Don’t know where to start? Catalyst can help. Our Strategy Sessions help walk you through the implications of the pending changes and navigate the options for your family.

Recommended

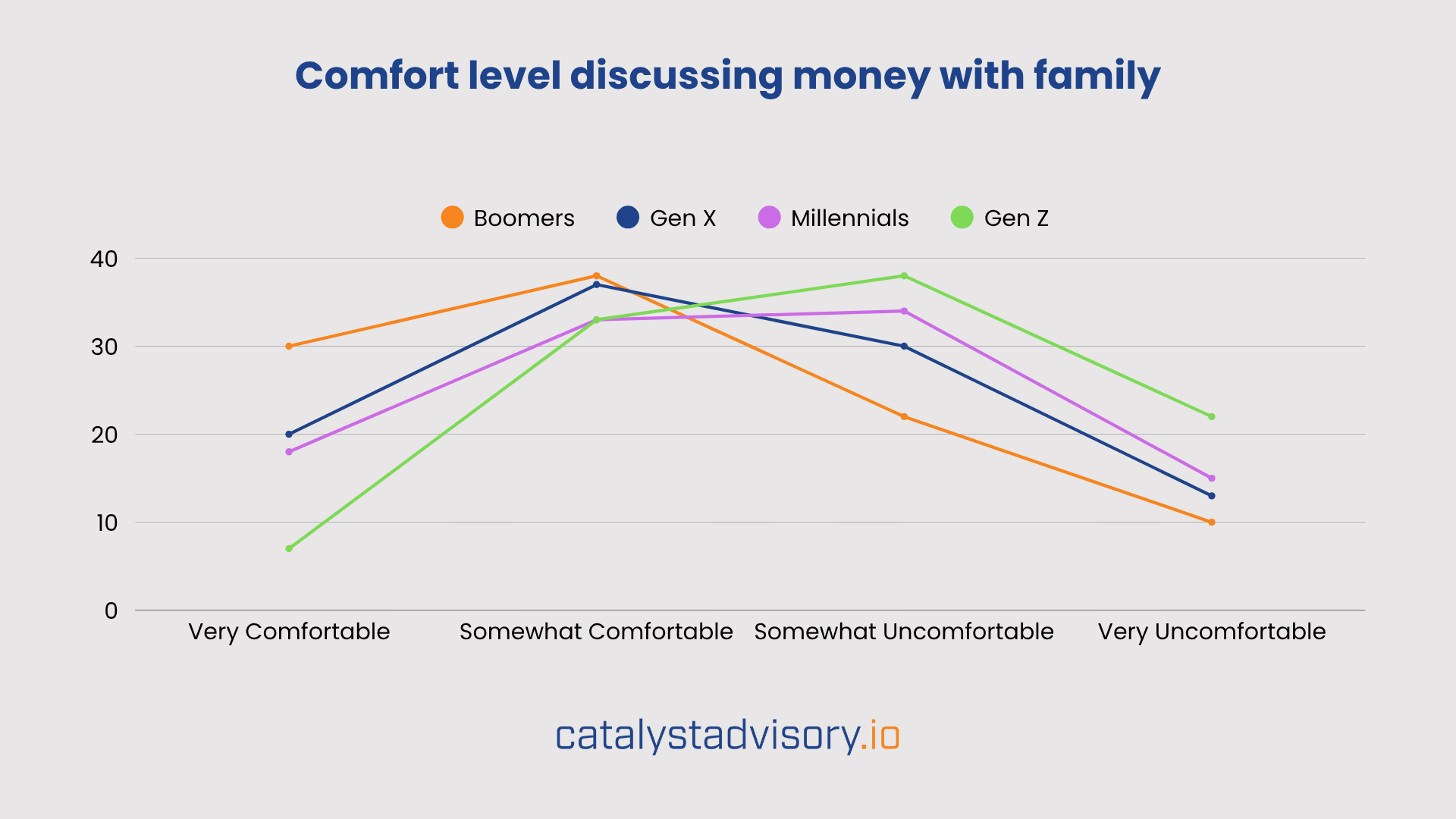

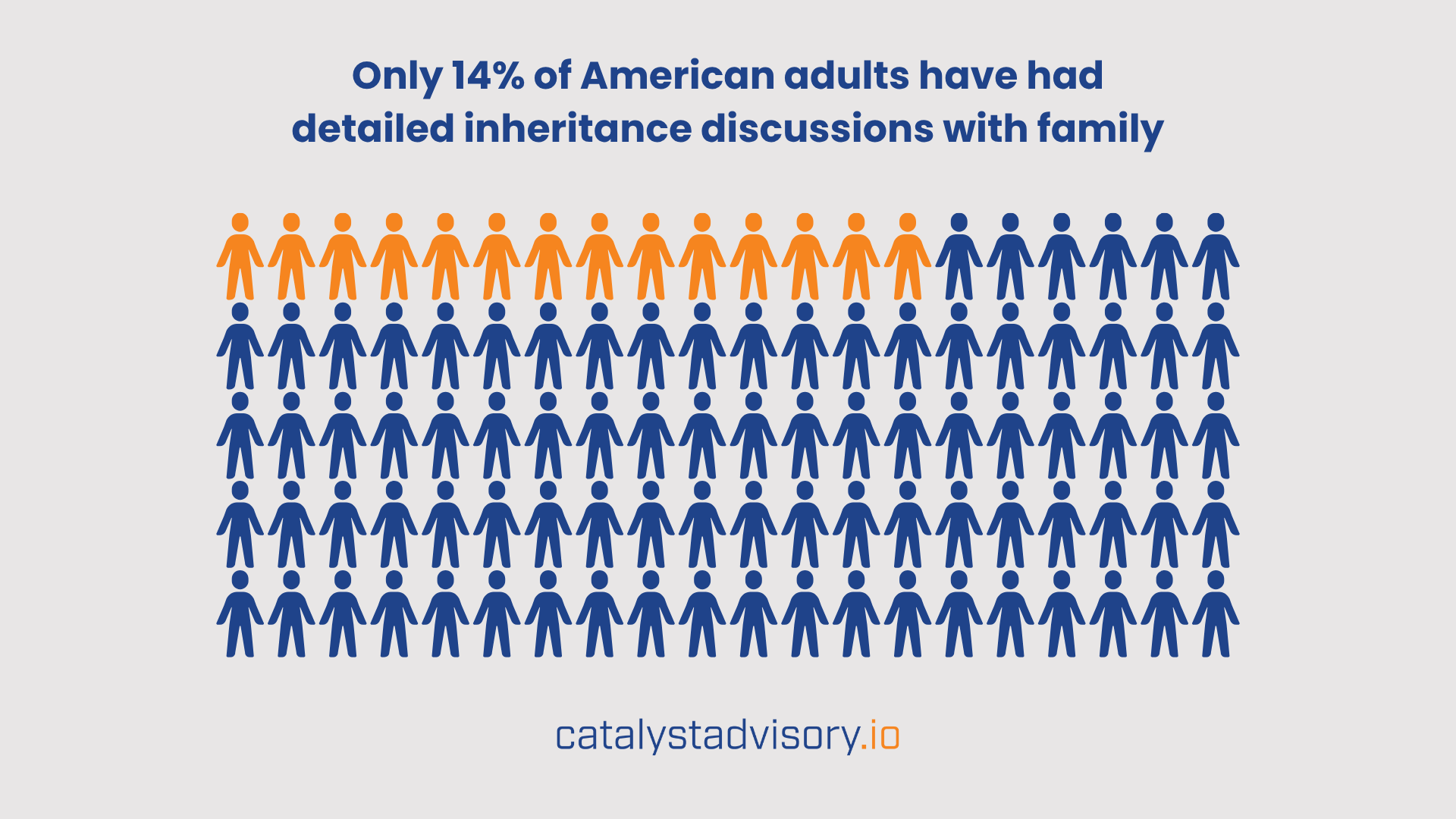

As the Great Wealth Transfer Begins, Most Families Remain Unprepared

January 6, 2026

The largest intergenerational wealth transfer in history is here. According to The Federal Reserve, Americans born before 1965 hold more than $105 trillion, or 63% of household wealth in the U.S. Over the next two decades, the Great Wealth Transfer will see most of that passed on to younger generations.

Estate Planning and the Great Wealth Transfer- National Survey Results

October 23, 2024

What our National Survey reveals about U.S. Families

Get All Our Stories in One Daily Email

It’s free. It’s daily. And it’s full of great reads, y’all.