Blogs,

The Hidden Costs of Underinsured Key Employees: A Business Owner’s Guide

What are the opportunity costs of losing the key employees that help build our businesses?

Pete Ro

October 21, 2024

October 21, 2024

The Hidden Costs of Underinsured Key Employees: A Business Owner’s Guide

Most business owners know their top performers—the ones whose absence would leave a serious gap. These “key employees” might be founders, executives, rainmakers, or technical experts. But what many owners overlook is this: if that person unexpectedly passes away, how financially exposed is the business?

Key person life insurance is one of those things you hope you’ll never need… but if you do, it can make or break the business’s ability to survive a major loss.

Most business owners know their top performers—the ones whose absence would leave a serious gap. These “key employees” might be founders, executives, rainmakers, or technical experts. But what many owners overlook is this: if that person unexpectedly passes away, how financially exposed is the business?

Key person life insurance is one of those things you hope you’ll never need… but if you do, it can make or break the business’s ability to survive a major loss.

What Does It Really Cost to Lose a Key Employee?

The immediate impact is obvious: lost revenue, disrupted operations, and the cost of finding and onboarding a replacement. But there are hidden costs too—declining client confidence, slower sales cycles, and internal morale hits. In some industries, the loss of a key person can even lead to a lower business valuation.

Without a plan in place, the business may need to dip into reserves or take on debt to stabilize. That’s a tough position to be in during a crisis.

Why Underinsurance Is More Common Than You Think

In many cases, business owners do have some coverage—but it’s often not enough. Maybe the policy was put in place years ago and hasn’t been reviewed. Or maybe the coverage amount was based on what felt comfortable rather than what was truly needed.

The real question is: if this person were gone tomorrow, how much money would the business need to stay steady while finding a replacement and retaining key clients and staff?

Insurance as a Strategic Business Asset

Key person life insurance is more than a safety net—it’s a strategic asset. It provides the liquidity to keep payroll running, pay off debts, or even buy out the equity of a deceased partner. In some cases, it can even help secure business loans by showing lenders there’s protection in place.

And when structured properly, it can also support succession planning or fund buy-sell agreements, giving everyone involved a clearer path forward.

When Was the Last Time You Reviewed Your Coverage?

If it’s been a while since you looked at your key person insurance—or if you’ve never explored it at all—now’s a good time. Your business has likely grown, and the roles people play have probably evolved.

A quick review with an independent advisor can help you assess your current coverage and identify any gaps.

Final Thoughts

Protecting your key people isn’t just about loyalty—it’s about keeping the business resilient. The cost of being underinsured doesn’t show up on the balance sheet until it’s too late. But with the right strategy in place, you can keep moving forward—even in the face of the unexpected.

The immediate impact is obvious: lost revenue, disrupted operations, and the cost of finding and onboarding a replacement. But there are hidden costs too—declining client confidence, slower sales cycles, and internal morale hits. In some industries, the loss of a key person can even lead to a lower business valuation.

Without a plan in place, the business may need to dip into reserves or take on debt to stabilize. That’s a tough position to be in during a crisis.

Why Underinsurance Is More Common Than You Think

In many cases, business owners do have some coverage—but it’s often not enough. Maybe the policy was put in place years ago and hasn’t been reviewed. Or maybe the coverage amount was based on what felt comfortable rather than what was truly needed.

The real question is: if this person were gone tomorrow, how much money would the business need to stay steady while finding a replacement and retaining key clients and staff?

Insurance as a Strategic Business Asset

Key person life insurance is more than a safety net—it’s a strategic asset. It provides the liquidity to keep payroll running, pay off debts, or even buy out the equity of a deceased partner. In some cases, it can even help secure business loans by showing lenders there’s protection in place.

And when structured properly, it can also support succession planning or fund buy-sell agreements, giving everyone involved a clearer path forward.

When Was the Last Time You Reviewed Your Coverage?

If it’s been a while since you looked at your key person insurance—or if you’ve never explored it at all—now’s a good time. Your business has likely grown, and the roles people play have probably evolved.

A quick review with an independent advisor can help you assess your current coverage and identify any gaps.

Final Thoughts

Protecting your key people isn’t just about loyalty—it’s about keeping the business resilient. The cost of being underinsured doesn’t show up on the balance sheet until it’s too late. But with the right strategy in place, you can keep moving forward—even in the face of the unexpected.

Recommended

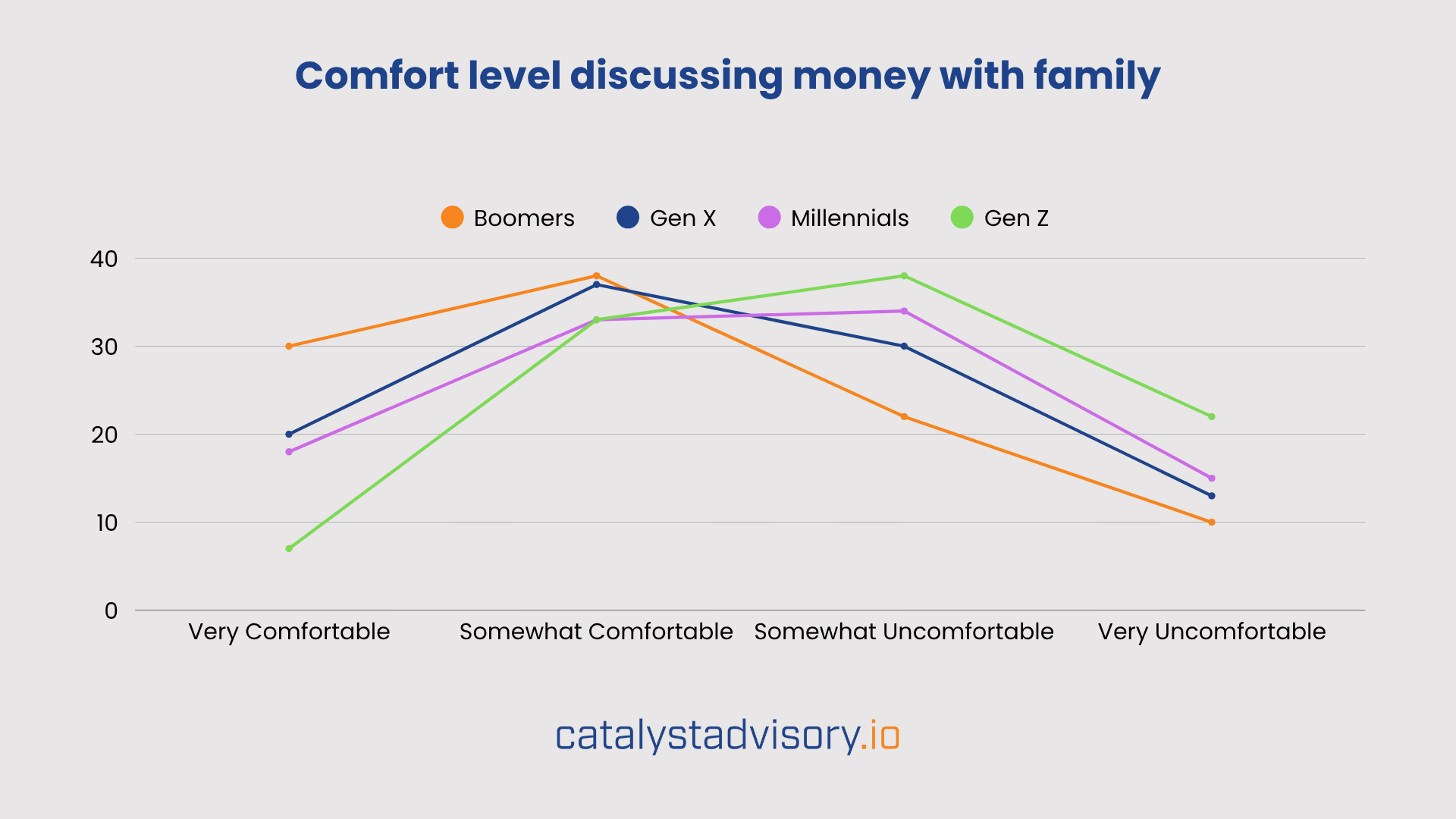

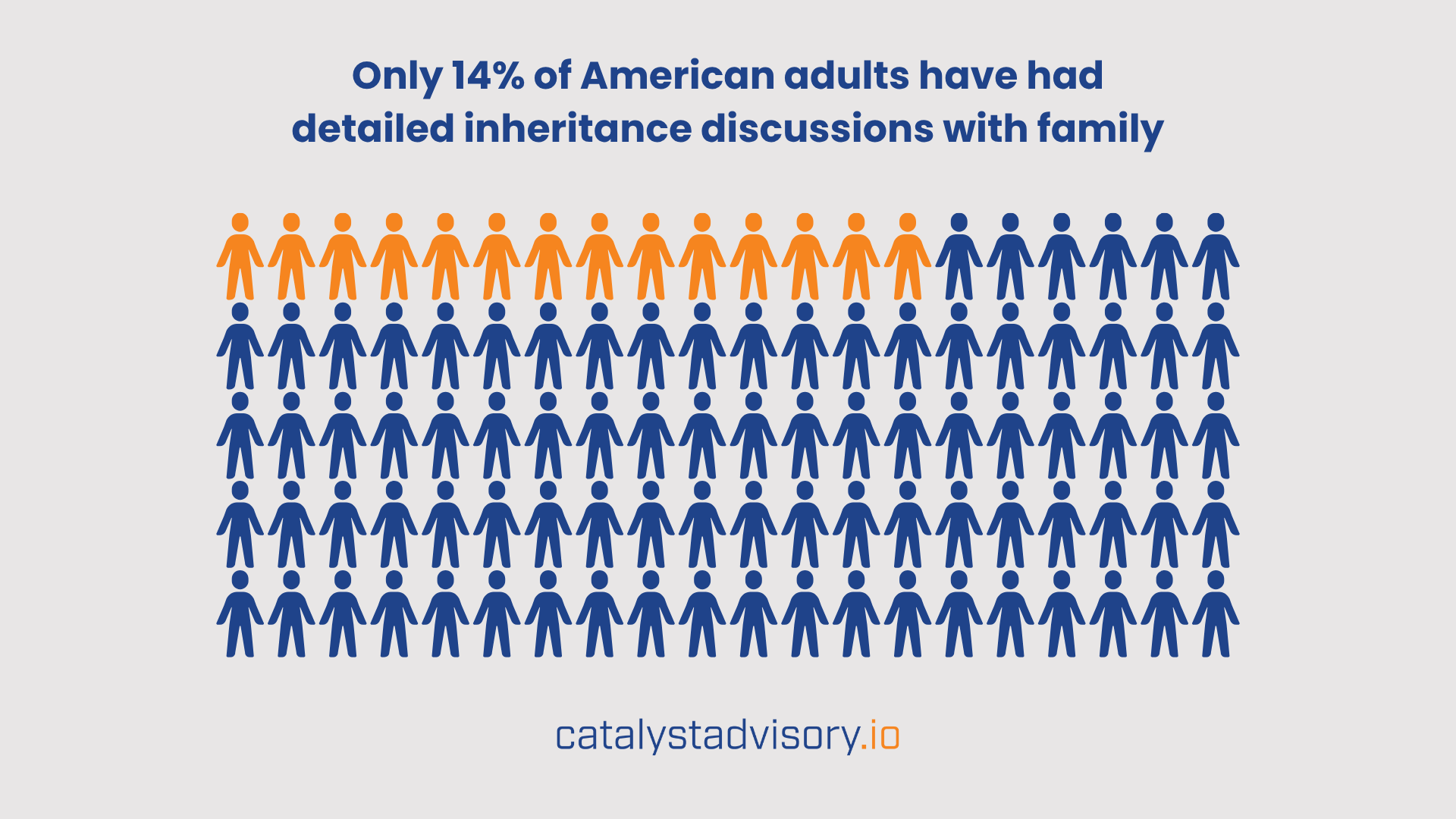

As the Great Wealth Transfer Begins, Most Families Remain Unprepared

January 6, 2026

The largest intergenerational wealth transfer in history is here. According to The Federal Reserve, Americans born before 1965 hold more than $105 trillion, or 63% of household wealth in the U.S. Over the next two decades, the Great Wealth Transfer will see most of that passed on to younger generations.

Estate Planning and the Great Wealth Transfer- National Survey Results

October 23, 2024

What our National Survey reveals about U.S. Families

Get All Our Stories in One Daily Email

It’s free. It’s daily. And it’s full of great reads, y’all.