Buy-Sell Agreements and the Connelly v. United States decision

The Connelly Case has serious implications for buy-sell agreements. Now is the time to make sure your advisors are reviewing agreements that include life insurance as a funding mechanism.June 12, 2024

The Connelly v. United States Decision and Its Implications on Buy-Sell Agreements

Understanding the Case

The recent Connelly v. United States decision has made waves in the business and legal communities, particularly for those involved in crafting and executing buy-sell agreements. The case revolves around the valuation of transferred interests in a closely-held business, shedding light on the complexities and considerations necessary for buy-sell agreements.

The recent June 4th decision in Connelly v. United States clarified how life insurance death benefits impact the valuation of a business when a partner dies. The court ruled that the death benefit from a life insurance policy should be included in the value of the deceased partner's interest in the business. This inclusion affects the overall business valuation and has significant tax implications. The decision emphasizes the necessity for businesses to account for life insurance proceeds in their buy-sell agreements and estate planning, ensuring that valuations reflect these benefits accurately to avoid disputes and compliance issues.

Background

In Connelly v. United States, the dispute centered on the proper valuation of stock transfers within a closely-held company. The IRS contested the valuation methods used, arguing that the transferred stock was undervalued, leading to significant tax implications. The court's decision emphasized the importance of accurate and fair valuation methods in such transactions.

Key Takeaways for Buy-Sell Agreements:

Valuation Accuracy: The court highlighted the need for using robust and defensible valuation methods. Buy-sell agreements must specify clear valuation procedures, whether through a fixed price, a formula approach, or independent appraisal. Ensuring that these methods are aligned with fair market value principles can mitigate disputes and potential IRS scrutiny.

Documentation and Consistency: Proper documentation is critical. The Connelly case underscored the importance of maintaining consistent records and supporting documentation for the chosen valuation method. Inconsistent or poorly documented valuations can lead to challenges and unfavorable outcomes.

Periodic Review and Updates: Businesses should periodically review and update their buy-sell agreements. Market conditions, business growth, and changes in tax laws can all impact the fairness and relevance of the agreed-upon valuation methods. Regular reviews help ensure the agreement remains appropriate and equitable for all parties involved.

Professional Appraisal: Engaging professional appraisers can add credibility to the valuation process. The Connelly decision suggests that independent, third-party appraisals are often viewed more favorably by the courts and the IRS. This step can be a proactive measure to defend against potential disputes.

Tax Implications: The case serves as a reminder of the significant tax implications tied to buy-sell agreements. Businesses must consider the tax consequences of their valuation methods and ensure compliance with IRS guidelines to avoid penalties and disputes.

Valuation Accuracy: The court highlighted the need for using robust and defensible valuation methods. Buy-sell agreements must specify clear valuation procedures, whether through a fixed price, a formula approach, or independent appraisal. Ensuring that these methods are aligned with fair market value principles can mitigate disputes and potential IRS scrutiny.

Documentation and Consistency: Proper documentation is critical. The Connelly case underscored the importance of maintaining consistent records and supporting documentation for the chosen valuation method. Inconsistent or poorly documented valuations can lead to challenges and unfavorable outcomes.

Periodic Review and Updates: Businesses should periodically review and update their buy-sell agreements. Market conditions, business growth, and changes in tax laws can all impact the fairness and relevance of the agreed-upon valuation methods. Regular reviews help ensure the agreement remains appropriate and equitable for all parties involved.

Professional Appraisal: Engaging professional appraisers can add credibility to the valuation process. The Connelly decision suggests that independent, third-party appraisals are often viewed more favorably by the courts and the IRS. This step can be a proactive measure to defend against potential disputes.

Tax Implications: The case serves as a reminder of the significant tax implications tied to buy-sell agreements. Businesses must consider the tax consequences of their valuation methods and ensure compliance with IRS guidelines to avoid penalties and disputes.

Practical Considerations

In light of Connelly v. United States, business owners and legal advisors should revisit their buy-sell agreements with a critical eye. Here are some practical steps to consider:

Inclusion of Death Benefits in Valuation: Following the June 4th decision in Connelly v. United States, businesses must ensure that life insurance death benefits are included in the valuation of the deceased partner's interest. This means revisiting and potentially revising buy-sell agreements to explicitly account for these benefits in the valuation process. Accurate inclusion of death benefits helps prevent disputes and ensures fair compensation for the deceased partner's estate.

Tax Implications: The court's decision highlights the significant tax implications of including life insurance death benefits in business valuations. Businesses should consult with tax professionals to understand how these benefits affect their tax obligations. Proper tax planning and compliance with IRS guidelines are crucial to avoid penalties and ensure smooth execution of the buy-sell agreement.

Conclusion

The Connelly v. United States decision is a crucial reminder of the complexities involved in buy-sell agreements. By emphasizing accurate valuations, thorough documentation, and periodic reviews, businesses can better navigate the potential challenges and ensure their agreements are fair, compliant, and robust against scrutiny. Taking these steps can help safeguard against disputes and ensure smooth transitions in business ownership.

Recommended

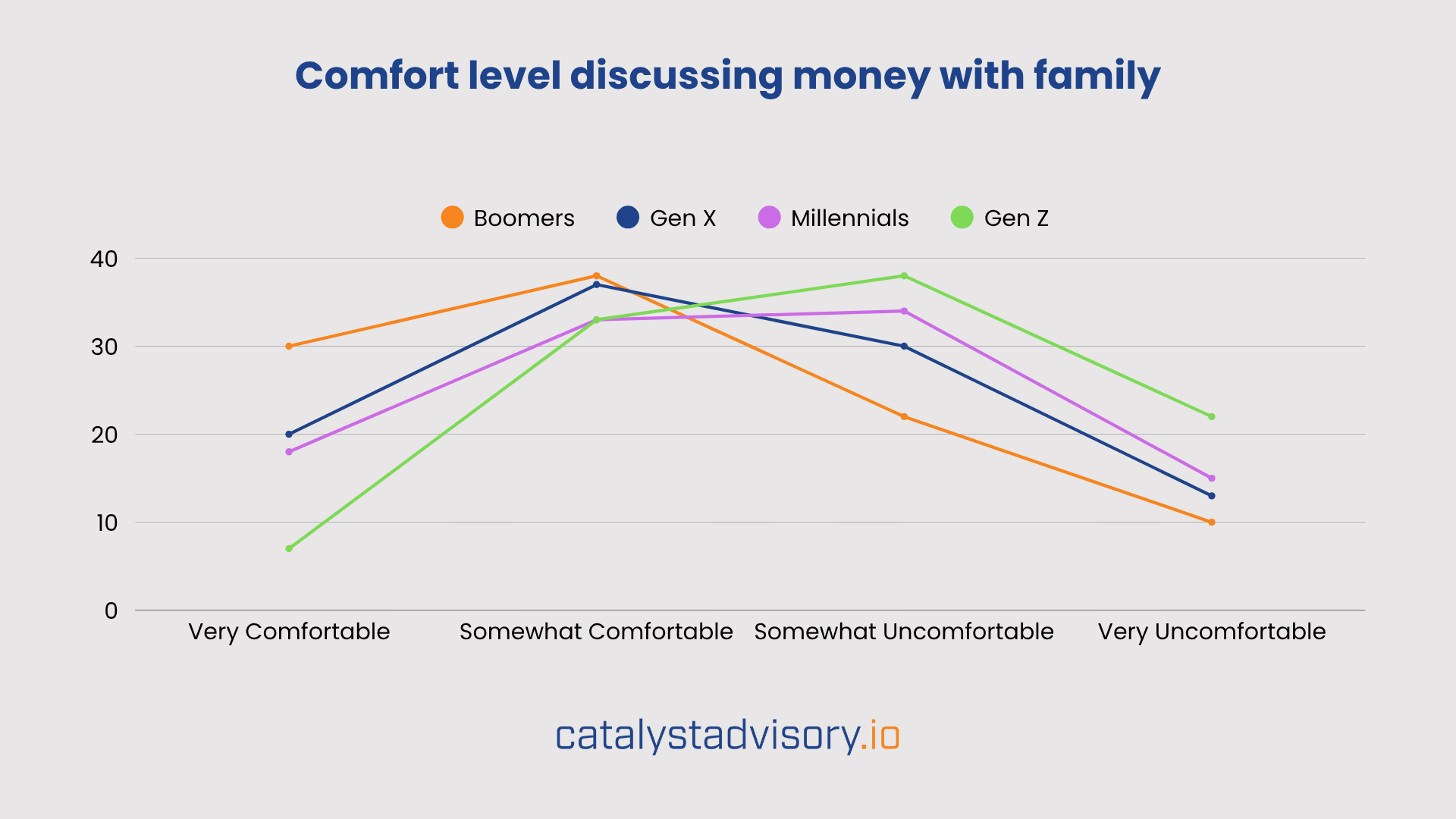

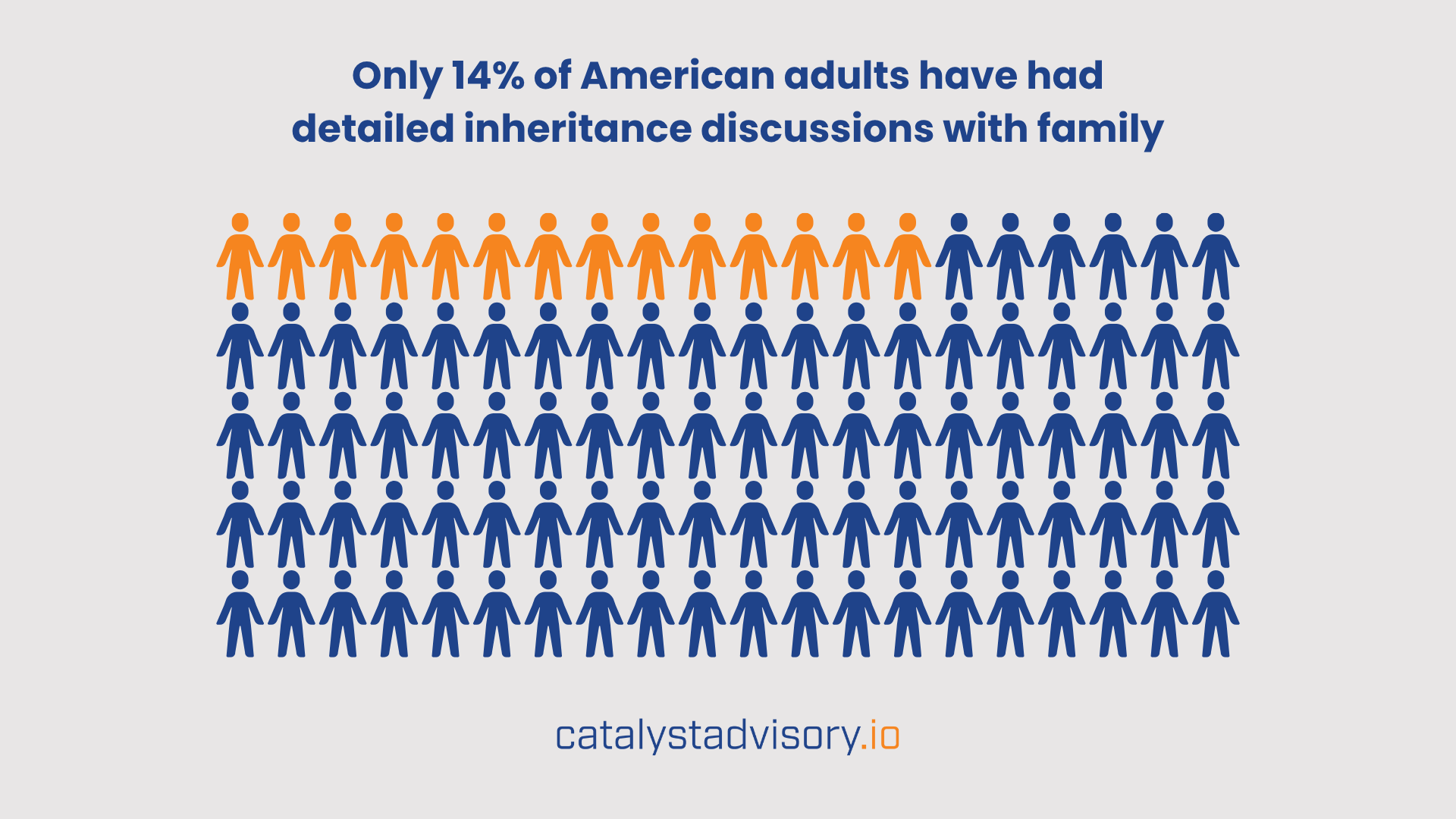

As the Great Wealth Transfer Begins, Most Families Remain Unprepared

January 6, 2026

The largest intergenerational wealth transfer in history is here. According to The Federal Reserve, Americans born before 1965 hold more than $105 trillion, or 63% of household wealth in the U.S. Over the next two decades, the Great Wealth Transfer will see most of that passed on to younger generations.

Estate Planning and the Great Wealth Transfer- National Survey Results

October 23, 2024

What our National Survey reveals about U.S. Families

Get All Our Stories in One Daily Email

It’s free. It’s daily. And it’s full of great reads, y’all.