The Great Wealth Transfer: Why Planning Matters Now

October 21, 2024

The Great Wealth Transfer: Why Planning Matters Now

American families are on the cusp of the largest financial transition in history. As Baby Boomers continue to age, with the oldest members of this generation now approaching 80, we're witnessing the beginning of the largest intergenerational wealth transfer in history.

Trillions of dollars in assets will change hands over the next two decades. How these transitions are managed will determine whether wealth is preserved, grown, or diminished through taxes, disputes, and poor planning.

Who Holds America's Wealth Today?

The latest data from the Federal Reserve paints a clear picture: older generations control the majority of household wealth in the United States.

Overall Household Wealth Distribution by Generation

Silent & Earlier (born before 1946): 12.1% ($20.18 trillion)

Baby Boomer (born 1946-1964): 51.1% ($85.41 trillion)

Gen X (born 1965-1980): 26.1% ($43.70 trillion)

Millennial (born 1981 or later): 10.7% ($17.97 trillion)

The data shows that 63% of all household wealth in America belongs to people who are 61 or older. That's $105.59 trillion held by the Silent Generation and Baby Boomers combined. Baby Boomers alone control more than half of the nation's household wealth, and they're now between 61 and 79 years old.

Breaking Down the Asset Classes

Different types of assets present unique challenges for wealth transfer, and understanding where older generations hold their wealth helps illustrate the complexity of the situation.

Corporate Equities and Mutual Funds

Silent & Earlier: 16.1% ($8.24 trillion)

Baby Boomer: 53.5% ($27.38 trillion)

Gen X: 21.9% ($11.20 trillion)

Millennial: 8.5% ($4.37 trillion)

When it comes to stocks and mutual funds, older generations hold an even larger share than their overall wealth percentage would suggest. Nearly 70% of all corporate equities and mutual fund shares belong to Americans over 60, representing over $35 trillion in market investments.

Real Estate

Silent & Earlier: 8.9% ($20.66 trillion)

Baby Boomer: 40.5% ($89.73 trillion)

Gen X: 29.3% ($50.57 trillion)

Millennial: 21.4% ($25.86 trillion)

In real estate, wealth is more distributed across generations than in other asset classes. Still, Baby Boomers lead at just over 40%, controlling nearly $90 trillion in residential and commercial property. Real estate transfers can be particularly complex and require proactive planning.

Private Businesses

Silent & Earlier: 11.8% ($1.84 trillion)

Baby Boomer: 50% ($7.76 trillion)

Gen X: 25.8% ($4.00 trillion)

Millennial: 12.4% ($1.93 trillion)

Private business ownership mirrors the overall wealth distribution, with Baby Boomers controlling half of all privately held business value. But the challenge here extends beyond just the dollar figures.

The Business Ownership Factor

According to the most recent U.S. Census data from 2022, 52.3% of all business owners are 55 or older. Breaking that down further, 29.5% of business owners are between 55 and 64, while 22.8% are 65 or older.

This presents a unique challenge. Unlike publicly traded stocks that can be easily divided and transferred, private businesses require careful succession planning. Who will run the company? Will it stay in the family or be sold? How do you ensure fair treatment of heirs who work in the business versus those who don't? These questions need answers well before the transfer becomes necessary.

What This Means: The Transfer Timeline

Those in the Silent Generation, born before 1946, are now at least 79 years old. Their $20 trillion in wealth is actively being transferred to their children (primarily Baby Boomers and older Gen Xers) and, in some cases, grandchildren. This has been underway for years, but it represents just a fraction of what's to come.

Baby Boomers, who hold more than $85 trillion, are now between 61 and 79 years old. The oldest Boomers are well into retirement, and the youngest are approaching it. Over the next 10 to 20 years, the bulk of this generation's wealth will pass on to Gen Xers and Millennials.

The Cost of Inaction

Here's an uncomfortable truth: without proper planning, a significant portion of this wealth won't make it to the next generation intact. Taxes, family disputes, forced asset sales, and administrative costs can eat away at inheritances.

Consider the business owner who assumes their children will "figure it out" when the time comes. Without clear succession plans, businesses often need to be sold quickly, often at unfavorable prices, simply to pay estate taxes or settle disputes among heirs. Family businesses that took decades to build can be dismantled in months.

Or think about the family with significant real estate holdings but no liquidity plan. Heirs may be forced to sell properties they'd prefer to keep simply to cover tax bills. That vacation home with decades of memories might have to go on the market at the worst possible time.

Then there's the human element. Unclear intentions lead to family conflicts. Unequal distributions without explanation lead to resentment and disputes. Lack of preparation leaves grieving family members to make complex financial decisions at the worst possible time.

The difference between planned and unplanned wealth transfer can be millions of dollars. More than that, it can be the difference between a family legacy that endures and one that fractures.

Taking the First Step

The data makes one thing abundantly clear: we're in the early stages of the largest wealth transfer in American history. Over $100 trillion will change hands in the coming decades, and how families prepare for this transition will determine whether wealth is preserved and purposefully directed or needlessly diminished.

If you're part of the generation holding this wealth, the time to plan is now. If you're expecting to receive an inheritance, encouraging these conversations, as difficult as they may be, is one of the most valuable things you can do.

The complexity varies by situation. A family with primarily liquid investments faces different challenges than one with a family business or extensive real estate holdings. But regardless of the asset mix, the principle remains the same: intentional planning produces better outcomes than hoping things will work themselves out.

This transfer is happening. The only question is whether it will be managed strategically or left to chance.

Recommended

As the Great Wealth Transfer Begins, Most Families Remain Unprepared

January 6, 2026

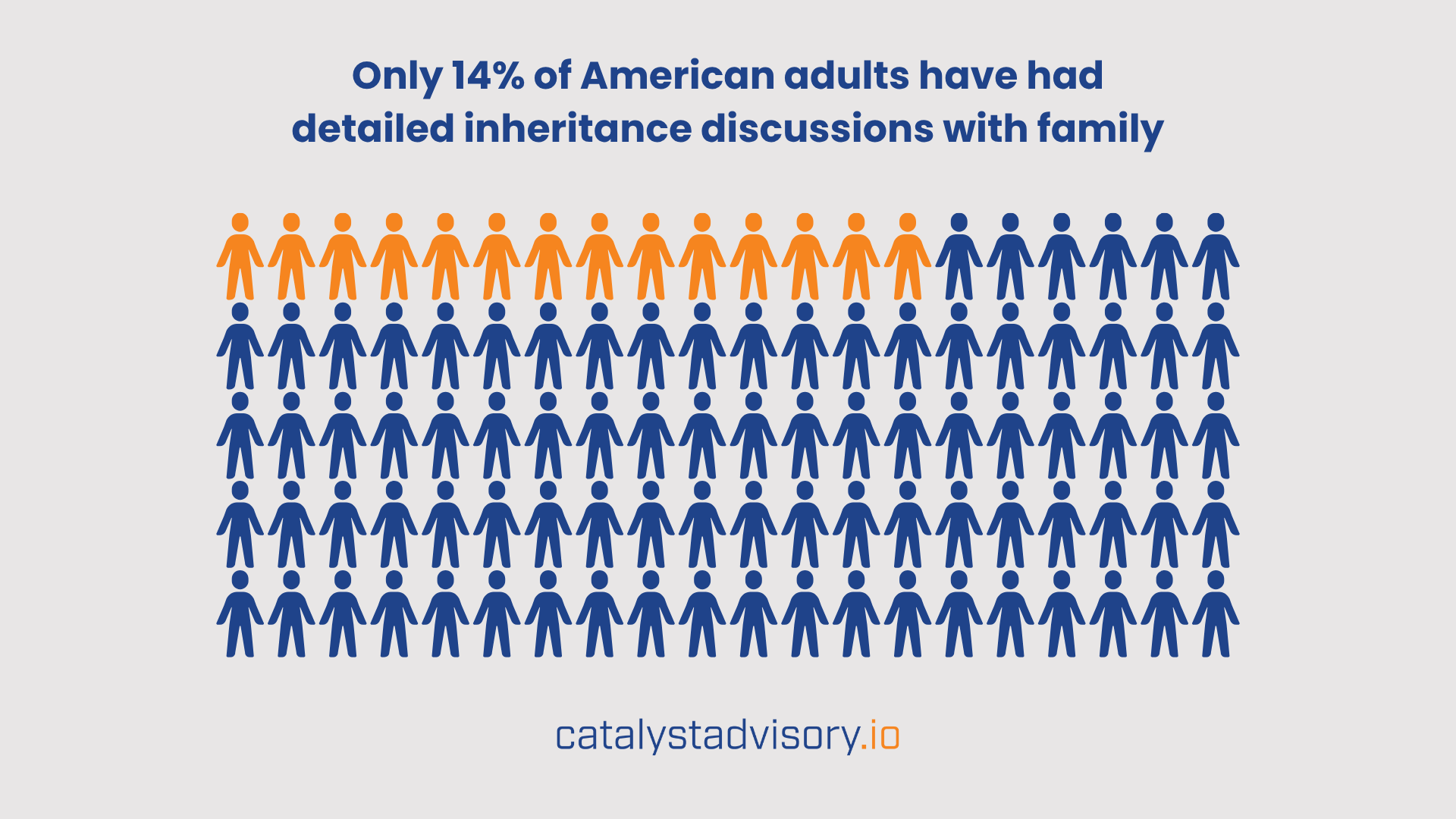

The largest intergenerational wealth transfer in history is here. According to The Federal Reserve, Americans born before 1965 hold more than $105 trillion, or 63% of household wealth in the U.S. Over the next two decades, the Great Wealth Transfer will see most of that passed on to younger generations.

Estate Planning and the Great Wealth Transfer- National Survey Results

October 23, 2024

What our National Survey reveals about U.S. Families

Get All Our Stories in One Daily Email

It’s free. It’s daily. And it’s full of great reads, y’all.