Estate Planning and the Great Wealth Transfer- National Survey Results

What our National Survey reveals about U.S. FamiliesOctober 23, 2024

Estate Planning and the Great Wealth Transfer: What Our National Survey Reveals About U.S. Families

The United States is entering one of the largest wealth transfers in its history, and many families are unsure how to prepare for it. Conversations about inheritance are often delayed or avoided, even when people want clarity about the future. As a result, expectations are sometimes unclear, and important decisions are left unresolved.

At Catalyst Advisory, we see these challenges regularly in our work with individuals and families. To gain a clearer picture of how people think about inheritance today, we conducted the Family Wealth in America study. We surveyed 1,000 adults across the country and asked about their expectations, plans for leaving wealth, and comfort level discussing inheritance with family members.

The findings provide a meaningful look at what families are talking about, what they are avoiding, and where the biggest gaps in communication appear as the Great Wealth Transfer continues to unfold.

Key Findings:

Only 14% of American adults have had detailed inheritance discussions

Nearly 1 in 4 Americans expecting an inheritance have never discussed it with family

91% of Americans don't want to die with zero: Only 9% plan to spend it all

Millennials are the most likely generation to expect an inheritance, and the least likely to leave one

Gen Z is nearly twice as likely to expect to leave an inheritance as to receive one

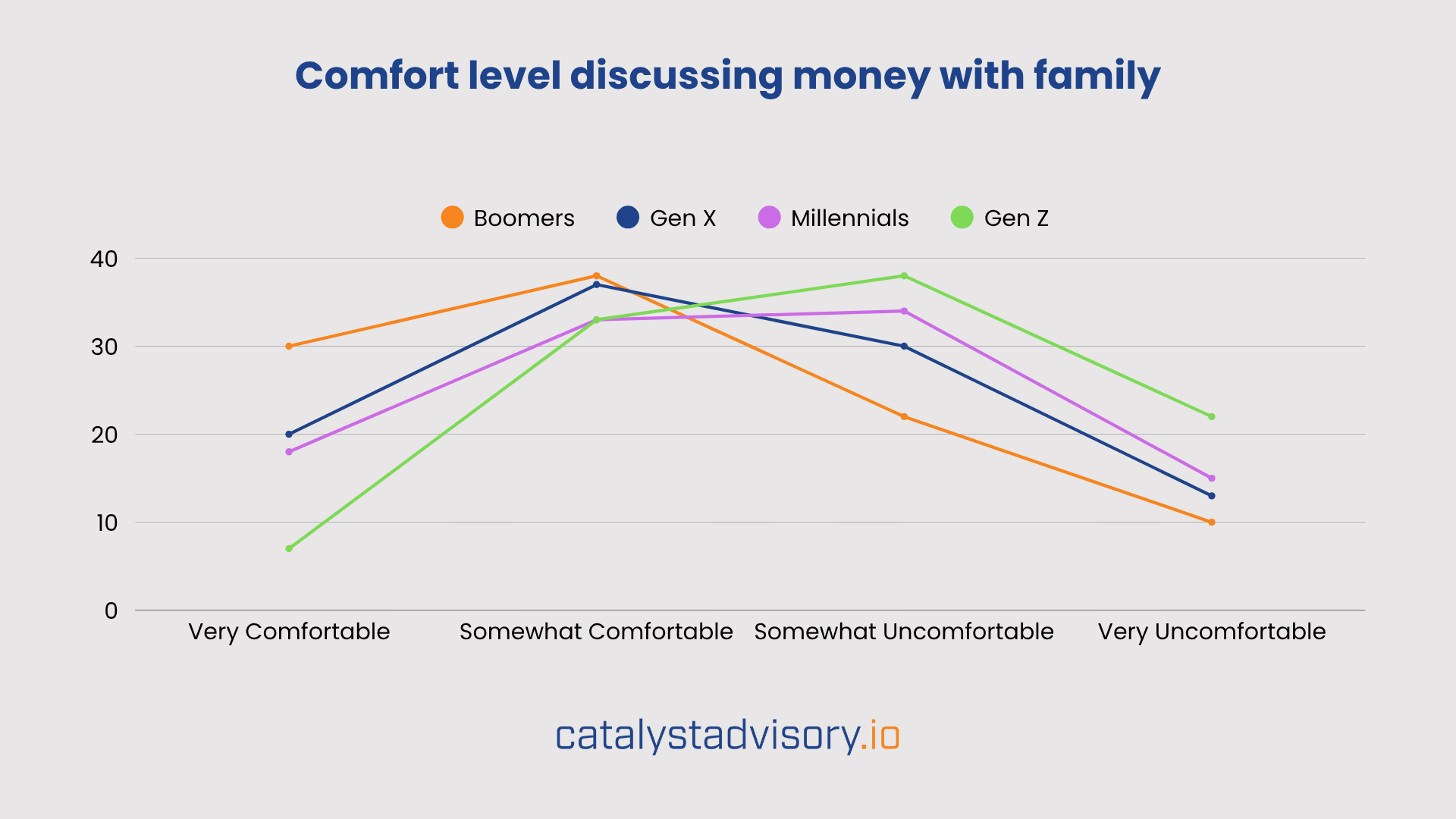

Gen Z is more than twice as uncomfortable discussing money as their grandparents

Men are more likely to expect an inheritance than women

Women are 43% more likely than men to be “very uncomfortable” discussing money with family

College graduates are 58% more likely than non-graduates to plan to leave an inheritance

Only 14% of American adults have had detailed inheritance discussions

Nearly 1 in 4 Americans expecting an inheritance have never discussed it with family

91% of Americans don't want to die with zero: Only 9% plan to spend it all

Millennials are the most likely generation to expect an inheritance, and the least likely to leave one

Gen Z is nearly twice as likely to expect to leave an inheritance as to receive one

Gen Z is more than twice as uncomfortable discussing money as their grandparents

Men are more likely to expect an inheritance than women

Women are 43% more likely than men to be “very uncomfortable” discussing money with family

College graduates are 58% more likely than non-graduates to plan to leave an inheritance

The Great Wealth Transfer is Coming, But America Isn’t Ready to Talk About It

One of the clearest themes from the survey is that most families are not having meaningful conversations about inheritance. Nearly half of Americans (49%) say they have talked about inheritance with family members, but these conversations have only covered general ideas or broad expectations. A much smaller group, only 14%, has discussed inheritance in detail. These are the types of conversations that help families understand intentions, plans, and responsibilities, yet they remain relatively rare.

Another 36% of adults have never discussed inheritance at all. A small number of respondents, less than 2%, said the topic was not applicable because they do not have family.

Even when people feel comfortable talking about money, many still avoid it in practice. Twenty-six percent of respondents who say they feel comfortable talking about inheritance have never actually had such conversations with their family. This gap between comfort and action suggests that many people view inheritance as important but still difficult to bring up.

The survey also shows that discomfort around these discussions is common. Nearly half of Americans (47%) say they feel uncomfortable discussing inheritance or family money. Even among the people who have had conversations with family members, almost half of them (48%) still feel uneasy about it.

The hesitation is especially noticeable among people who expect to receive money in the future. Among the 340 respondents who think they may receive an inheritance, 101 have never talked about it with their family. The pattern is similar for those who expect an inheritance with certainty. Of the 297 respondents who definitely expect an inheritance, 40 have never discussed it. When combined, these groups show that 22% of people who expect or think they may get an inheritance have never discussed it with anyone in their family. This creates a significant amount of uncertainty at a time when clarity could make a meaningful difference.

These findings suggest that many families are entering the Great Wealth Transfer without clear communication and shared expectations. For many households, the first step toward better planning may simply be opening the conversation.

Most Americans Want to Leave Something Behind

One of the clearest insights from the survey is that most Americans do not subscribe to the “die with zero” philosophy. Ninety-one percent said they would leave something behind if they were wealthy, while only 9% said they would spend everything during their lifetime. This indicates that the idea of legacy is important for nearly all families, even if they have not discussed the details.

The data shows meaningful differences between generations. Younger adults are about twice as likely as Baby Boomers to say they would spend everything. About 9.2% of Gen Z, 10.2% of Millennials, and 9.9% of Gen X say they would spend all of their assets. Only 4.9% of Boomers say the same.

There are also differences in how people think about giving. For example, 5.6% of Boomers say they would donate most of their inheritance to charity if they were wealthy, compared to only 2.6% of Gen Z. These differences suggest that attitudes about legacy vary with age, but the overall intention to leave something for the next generation remains extremely common.

Generational Differences Show Contrasting Expectations and Comfort Levels

The survey reveals notable differences in how each generation views inheritance. Millennials stand out as the group most likely to expect an inheritance, with 33% saying they definitely expect to receive one. However, they are tied for the least likely to say they plan to leave an inheritance, with only 39% indicating they expect to pass wealth on. Gen Z shows the opposite pattern. Only 21% expect to receive an inheritance, but 41% expect to leave one. Baby Boomers remain the most likely to leave an inheritance, while Gen X falls in the middle on both expectations and giving.

Comfort levels with discussing money also vary significantly by generation. Gen Z reports the highest level of discomfort, with 22% saying they feel very uncomfortable talking about inheritance or family money. This is more than double the rate of Baby Boomers (10%). Boomers are also the most likely to feel very comfortable discussing inheritance, while Gen Z is the least likely, with only 7% saying they feel very comfortable.

The younger generation is poised to inherit more wealth than any generation before them, yet they also report the greatest hesitation when it comes to discussing money. These contrasting expectations and comfort levels suggest a need for clearer communication and more proactive planning as the Great Wealth Transfer continues.

Gender Differences in Expectations and Comfort Levels

The survey also highlights clear differences between men and women when it comes to inheritance expectations and discussions about money. Men are more likely to expect an inheritance, with 32% saying they definitely expect to receive one, compared to 28% of women. Men are also more likely to say they expect to leave an inheritance, with 45% indicating they plan to pass down wealth, compared to 36% of women.

When it comes to discussing money with family, women report higher levels of discomfort. About 17% of women say they feel very uncomfortable talking about inheritance or family finances, while 12% of men say the same. The gap appears in other comfort levels as well. Men are slightly more likely to feel very comfortable with these conversations, at 20% compared to 19% of women, and women are more likely to fall into the very uncomfortable category.

Education Level Impacts Who Plans to Pass Down Wealth

Education appears to play a meaningful role in whether someone expects to leave an inheritance. College graduates are 58% more likely to say they plan to pass down wealth compared to those without a college degree.

Percentage who definitely plan to leave an inheritance:

Doctorate degree (PhD): 61.3%

Graduate degree (MA/MSc): 48.4%

Bachelor's degree: 45.3%

Technical/community college: 29.0%

High school diploma: 31.1%

Secondary education (GED/GCSE): 25.0%

No formal qualifications: 0.0% (only 3 respondents fell into this category)

Conclusion

The Great Wealth Transfer will impact millions of families throughout the U.S., yet many are entering this period without clear conversations or shared expectations. The survey results show that most Americans want to leave something behind, but many have not discussed how that should happen or what it will look like. Generational differences, gender gaps, and varying levels of comfort all shape how families think about inheritance, and in many cases, these differences create uncertainty.

Better communication can help families prepare for the future with more confidence. Even a simple conversation can clarify intentions, reduce misunderstandings, and set the stage for more thoughtful planning. As the transfer of wealth continues to accelerate, families that take the time to talk openly about inheritance and long-term goals will be in a stronger position to navigate the decisions ahead.

Recommended

As the Great Wealth Transfer Begins, Most Families Remain Unprepared

January 6, 2026

The largest intergenerational wealth transfer in history is here. According to The Federal Reserve, Americans born before 1965 hold more than $105 trillion, or 63% of household wealth in the U.S. Over the next two decades, the Great Wealth Transfer will see most of that passed on to younger generations.

Estate Planning and the Great Wealth Transfer- National Survey Results

October 23, 2024

What our National Survey reveals about U.S. Families

Get All Our Stories in One Daily Email

It’s free. It’s daily. And it’s full of great reads, y’all.